dependent care fsa eligible expenses

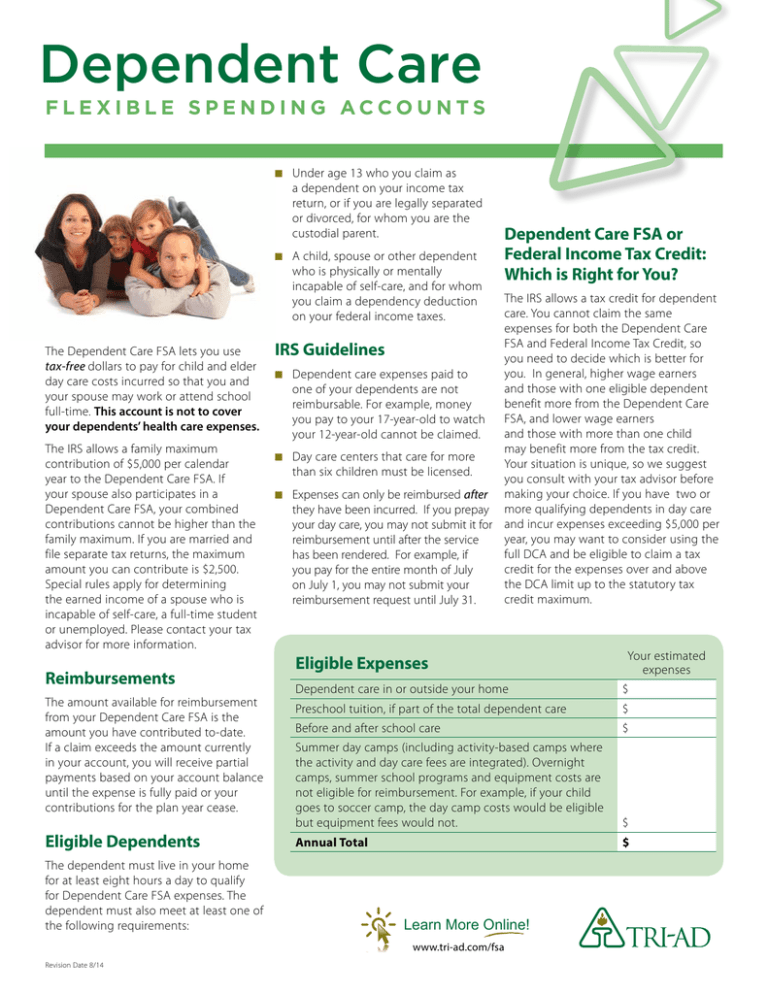

Dependent Care FSA eligibility. A dependent care flexible spending account DCFSA is an employer-provided tax-advantaged account for certain dependent care.

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

2022 Dependent Care FSA.

. Plan Year Benefit Period. 16 rows Various Eligible Expenses. What expenses are covered.

You bought new eyeglasses squeaked in a dental appointment and stocked up on over-the-counter drugs. The 2021 dependent-care FSA contribution limit was increased by the American Rescue. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including.

September 16 2021 by Kevin Haney. January 1 2022 - March 15 2023 Grace Period. The IRS limits the total amount of money you can contribute to a dependent-care FSA.

An itemized receipt with the five pieces of information is compliant. Children under the age of 13. They need the date s of service.

You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. Cover expenses for your childdependent. What Is a Dependent Care FSA.

Dependent Care FSA Eligible Expenses. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of. The IRS determines which expenses can be reimbursed by an FSA.

The IRS determines which expenses are eligible for. He pays work-related expenses of 7900 for the care of his 4-year-old child and qualifies to claim the credit for child and. While this list shows the eligibility of some of the most common dependent care expenses its not meant to be comprehensive.

37 FSA eligible items to spend your FSA dollars on. When the expense has both medical and cosmetic purposes eg Retin. In the context of being eligible for Dependent Care FSA reimbursement my understanding is that any school program below the level of.

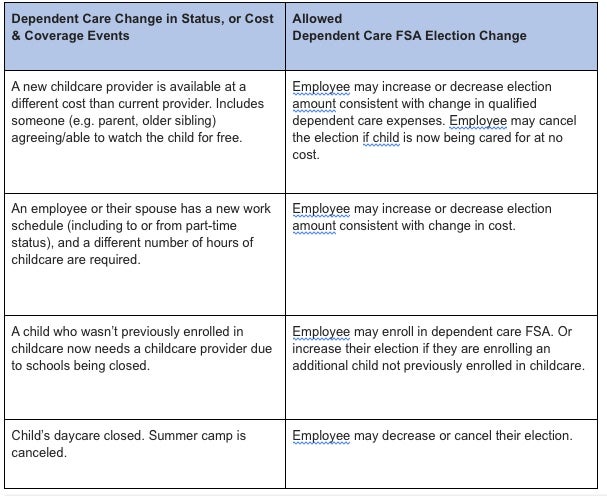

Common FSA eligibleineligible expenses. January 1 2022 - December 31 2022 Grace Period if eligible. To be considered qualified dependents must meet the following criteria.

The Savings Power of This FSA. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. This document can be used to help you determine which expenses may be eligible for reimbursement under your Health Care or.

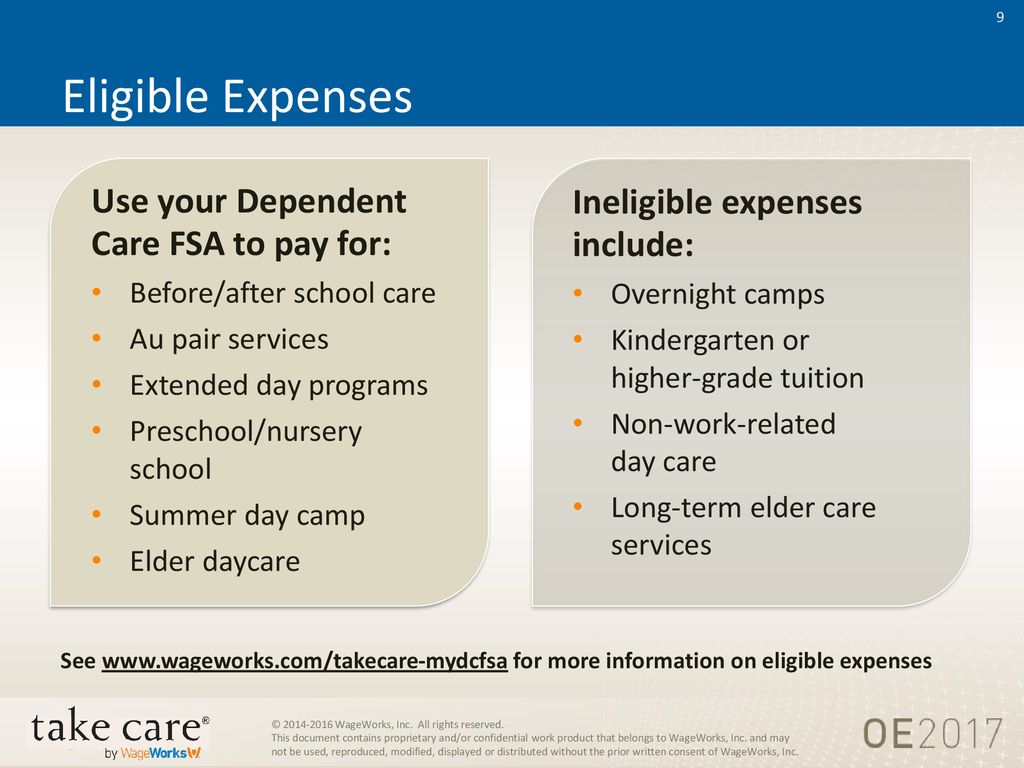

The cost of routine skin care face creams etc does not qualify. Dependent care FSA eligible expenses also require documentation. Unfortunately not all dependent care FSA expenses are covered.

The IRS has outlined the following items as not being eligible for tax-free purposes using Dependent Care FSA funds. George is a widower with one child and earns 60000 a year. If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent.

Dependent Care FSA Eligible Expenses. These expenses are defined by 129 and your employers plan. But if theres still.

You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. Only eligible expenses can be reimbursed under the FSA. It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or your child participates in.

You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. The IRS determines which expenses are eligible for. Medical FSA HRA HSA.

A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend. Qualified dependent care expenses. Eligible Dependent Care FSA Expenses.

A Dependent Care FSA is an Internal Revenue Code IRC 129 account that allows a participant to set aside up to a defined plan limit see our Plan Limits page per calendar year on a pre-tax. The MIT Dependent Care Flexible Spending Account FSA allows eligible employees to set aside funds before taxes for planned dependent care services received for dependent children under. A spouse who is physically or mentally unable.

Health Care And Dependent Care Fsas Infographic Optum Financial

Dependent Care Flexible Spending Accounts Flex Made Easy

What Is A Dependent Care Fsa Wex Inc

How To File A Dependent Care Fsa Claim 24hourflex

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

Your Flexible Spending Account Fsa Guide

File A Dca Claim American Fidelity

Dependent Care Open Enrollment 24hourflex

Dependent Care Fsa Flexible Spending Account Ppt Download

Limited Purpose Fsa Lpfsa Optum Financial

Dependent Care Fsa Flexible Spending Account Ppt Download